TSA Checkpoint Numbers

TSA checkpoint numbers for the last month have been slowly but steadily increasing. May 8th was the first time that checkpoint traffic exceeded 200k travelers in over a month and a half. Even then, TSA traffic is down 82% compared to the same dates last year. For the past month, passenger throughput has been hovering around 100k. March 2nd is the first day where traffic seems to be impacted, by March 17th, traffic is below 1M, and traffic bottomed out by April 2nd.

Atlanta Hartsfield-Jackson FAA Traffic

The FAA traffic reports have detailed counts of all airplanes flying in and out of Hartsfield-Jackson for the month of March. These charts show when airliner traffic was affected for Atlanta specifically. Though TSA throughput began to decline on March 2nd, Airliner traffic stayed relatively stable (around 2500 flights in and out per day) until around March 17th, when it began to dip. By the end of March, airline traffic had decreased more than 60%, hovering around 1000 flights per day. Presumably, this number has decreased even more for the month of April as airliners have restructured their scheduling, however the FAA reports lag nearly two months behind current day.

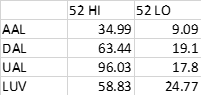

Airline Stock: Big Four

The big four airlines: American, Delta, Southwest, and United Airlines focus on “Hub and Spoke” models of airplane scheduling, and appeal to business travelers, frequent fliers, and those looking for extra frills on their flights. YTD, their stocks are down between 55-70%: Southwest (55%), Delta (60%), American (65%), United (70%). Q1 Earnings calls for these companies did little to bolster share prices and investor confidence. 52-week highs and lows for these companies are as follows:

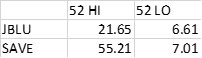

Airline Stock: Budget Airlines

Notable American budget airlines: Jet Blue and Spirit. These airlines operate in a point to point system as opposed to the hub-and-spoke system that the big four operate in. They are a no-frills airline that is more popular with domestic travelers and infrequent fliers. They have not fared any better than their more expensive counterparts: YTD, Jet Blue is down 58% while Spirit is down 73%. Their 52-week H/L is as follows:

Follow Us!