April Georgia Sales Tax Report Summary

April Sales Tax Overview

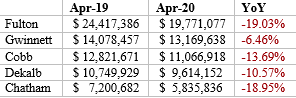

Georgia’s April gross sales tax and use collections declined by 9.7% compared to 2019. The hardest hit industries are accommodation (73.33%), auto (-12.43%), and general merchandise (-11.63%). The only industry to post positive growth is utilities with a 3.72% gain. The table below shows how the 5 largest sales tax generating counties, which contributed 40.21% of all sales tax in April, performed.

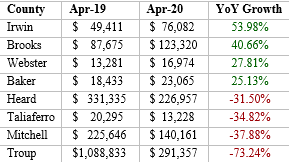

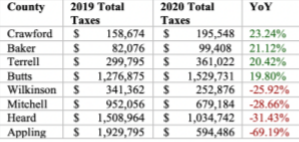

The next table shows Georgia’s top and bottom counties in sales tax growth (0.62% total sales tax contribution in April 2020).

New GA Sales Tax Law – HB 276

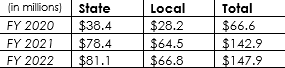

Effective April 1st, 2020, HB 276 states marketplace facilitators (Examples: eBay, DoorDash, Uber, Airbnb) are required to collect and remit sales tax when its Georgia tied sales is or exceeds $100,000 in the previous or current year. This makes the marketplace seller (Uber driver or Airbnb host) no longer liable to collect and remit sale taxes when the market facilitator reaches $100,000 in sales. The bill directly affects the food delivery/rideshare (Uber, GrubHub), online lodging/booking (Expedia, Airbnb), and e-commerce (eBay, Etsy) verticals. The table below shows the estimated state and local sales tax gains of the bill.

Georgia Partial Reopening

Governor Kemp allowed gyms/fitness centers, barber shops/hair salons, and nail salons on April 24th. On April 27th, theaters, private social clubs, and dining in at restaurants were reopened. The governor’s statewide shelter-in-place expired on midnight April 30th, but extended his emergency powers until June 12th. Sales tax revenue was still down significantly YoY in the affected verticals: Food/bars (-7.72%), Other Services (-10.03%), Misc. Services (1.23%).

Sales Tax Future Outlook

Georgia Budget & Policy Institute (GBPI) gave the following recommendations to generate sales tax to make up the anticipated $3 billion loss: increasing the cigarette tax to national average $1.81 (currently $0.37) and eliminating some tax credit programs like reducing the film industry tax credit which has $2 billion in unused credits currently. Estimates show $9.8 billion in foregone revenue from tax credits in fiscal 2020.

April Georgia Sales Tax Report Graphs

Travel, leisure, and nonessential shopping were severely impacted in April. Since March 21st, the Georgia Department of Labor has processed 1,597,593 initial unemployment claims, and the sectors with the most claims are as follows: Accommodation & Food Services, 446,437, Health Care & Social Assistance, 183,328, Retail and Trade, 182,663, Admin & Support Services, 130,039, and Manufacturing, 122,772. A severely reduced workforce will reduce discretionary spending making a May recovery difficult.

Year to Date Georgia Sales Tax Report Summary

YTD (Jan-Apr) Sales Tax Overview

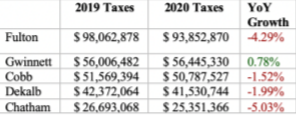

YTD Sales Tax collected in Georgia has declined -0.46% compared to 2019 for the same period (Jan-Apr). Accommodation represents the steepest decline at 22.64%, followed by utilities (-7.18%) and auto (-2.26%). The highest average gain industries were other retail (5.46%), general merchandise (2.66%), and construction (2.23%). Figure 1 shows how the 5 largest sales tax-generating counties, which contributed 42.41% of all sales tax in the time period, performed. Figure 2 shows Georgia’s top and bottom counties in sales tax growth (0.75% total sales tax contribution YTD). January had the highest gross sales tax and use collection growth at 4.8%.

Amidst rising Georgia COVID-19 cases, Savannah canceled its 196-year-old St. Patrick’s Day parade which brings in an estimated 500,000 tourists. On April 6th, Governor Kemp’s shelter in place began—closing all nonessential businesses. This caused a drastic reduction in economic activity, plummeting Georgia state and local sales tax revenue

Bankruptcy in GA

The below graphs show all types of bankruptcies filed in the northern, middle, and southern Georgia courts compared to 2019. Please note, Southern GA did not have data for March and April and their 2019 counterparts are not included in the YoY Change

April Georgia Sales Tax Report: Good and Bad News

Good News

HB 276 expected to bring $66.6 million in sales tax revenue in 2020

Georgia lifted stay at home orders and opened up most businesses

$9.8 billion in foregone revenue from tax credits for fiscal year 2020 to make up for sale tax decline

Bad News

GDOL has processed 1,597,593 initial unemployment claims since March 21st 2020

Georgia sales tax revenue down 8.54% in April month

Georgia net tax collections down 35.9% (-$1.03 billion)

Governor asks state department to prepare for a 14% reduction in FY21 state budget

Northern district GA had 1,150 bankruptcy filings in April

Follow Us!