August Sales Tax Overview

Georgia’s August gross sales and use collections grew +5.6% YoY. 6 industries posted negative growth this month. The top 3 industries that experienced the most sales tax growth YoY this month are other retail (+24.68%), auto (+19.69%), and other services (+8.26%).

The table below shows how the 5 largest sales tax-generating counties, which contributed 41.29% of all sales tax in August, performed.

| County | 2020 | 2019 | YoY Change |

| Fulton | $22,212,691.01 | $23,942,080.38 | -7.22% |

| Gwinnett | $15,051,911.03 | $14,883,167.91 | 1.13% |

| Cobb | $13,595,596.23 | $14,055,662.84 | -3.27% |

| Dekalb | $10,589,095.81 | $10,800,262.99 | -1.96% |

| Chatham | $ 6,637,275.24 | $ 7,083,002.41 | -6.29% |

The next table shows Georgia’s top 5 and bottom 5 counties in terms of sales tax growth (loss). The 10 counties account for 4.66% of Georgia’s total sales tax revenue generation in August 2020.

| County | 2020 | 2019 | YoY Change |

| Burke | $ 1,149,609.12 | $ 466,300.78 | 146.54% |

| Taylor | $ 96,111.77 | $ 63,119.34 | 52.27% |

| Glascock | $ 21,412.94 | $ 14,086.32 | 52.01% |

| Chattaho | $ 104,298.39 | $ 72,183.52 | 44.49% |

| Appling | $ 351,811.76 | $ 250,328.20 | 40.54% |

| Berrien | $ 76,156.18 | $ 127,281.18 | -40.17% |

| Heard | $ 259,798.69 | $ 420,348.55 | -38.19% |

| Clay | $ 14,328.77 | $ 20,176.86 | -28.98% |

| Bibb | $ 2,191,624.27 | $ 2,953,857.98 | -25.80% |

| Clayton | $ 3,412,430.32 | $ 4,590,562.31 | -25.66% |

Source: Georgia Department of Revenue Sales Tax Commodity Report

Other Tax Collection Revenue

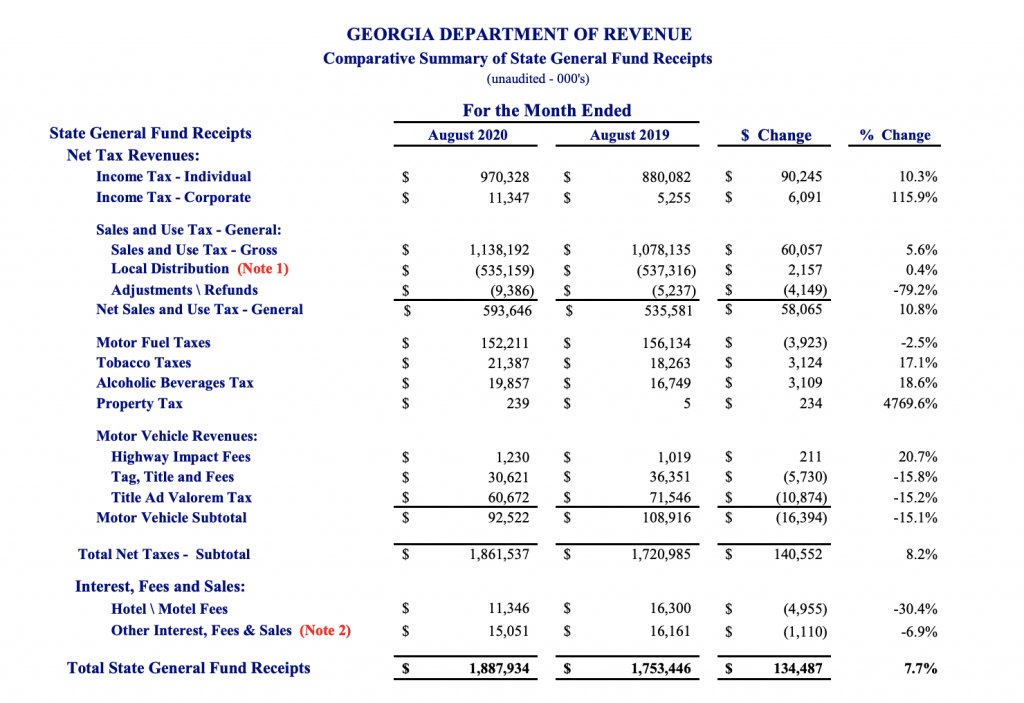

Individual Income Tax: August collections increased by 10.3% (+$90.2 million) with a total sum of ~$970.3 million.

- Income tax collections had been bolstered by tax withholding on unemployment checks (withholding collections totaled to ~$120 million a month from the unemployed, versus the typical $1 million to $5 million)

Corporate Income Tax: August collections increased by 115.9% (+$6.1 million) from $5.3 in 2019 to $11.4 in 2020. The large jump is due to:

- Corporate refunds issued down by 29.1% (-$5.8 million)

- Corporate income estimated tax payments up by 112.2% (+$5.1 million)

- All other corporate tax categories up a combined $4.8 million

Motor Fuel Taxes: August collections decreased by 2.5% (-$3.9 million) totaling to $156.1 million.

Motor Vehicle – Tag & Title Fees: August collections decreased by 15.8% (-$5.7 million). Title ad Valorem Tax (TAVT) declined by -15.2% (-$10.2 million).

Source: Georgia Department of Revenue Press Releases

Georgia Select Policy Changes

For fiscal 2022, which begins next July 1, Kemp is asking for no new reductions. The current fiscal year has seen a finalized budget cut of about 10% ($2.2 billion) with $950 million being reduced basic aid for school systems.

August Sales Tax Report Graphs

Since July’s spike in sales tax generation, growth declined in manufacturing (+11.98% in July to -11.33% in August YoY), misc services (+4.08% in July to -7.75% in August YoY), and construction (+18.18% in July to +3.12% in August YoY). Accommodation and utilities, although posting negative growth, continue to show signs of a slow and steady recovery, unlike other industries.

The reopening of the economy has brought about sales tax growth for the past 2 months, however, with a large increase in COVID-19 positive cases. As of August 31st, there have been 3,752 COVID-19 related deaths in Georgia.

Chart Source: Georgia Department of Revenue Sales Tax Commodity Report

August Georgia Sales Tax Report: Good And Bad News

Good News

Overall State tax revenue up $134 million in August

Despite COVID-19, job creation was 1.5 times higher in July 2020 and August 2020 compared to last last year

Kemp to Georgia agencies: no new budget cuts next fiscal year

Bad News

The number of COVID-19 cases has risen in Georgia and many other states.

Georgia has finalized the FY 2021 budget cut (-$2.2 billion)

Appendix

Follow Us!