September Sales Tax Overview

September Sales Tax Highlights

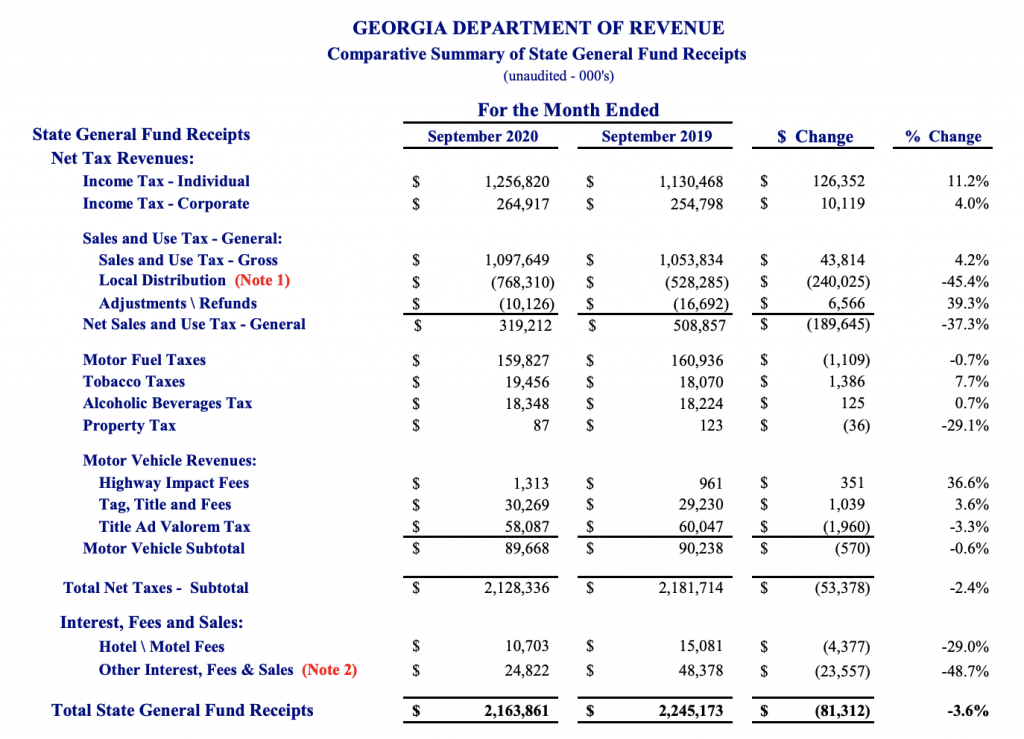

- Gross Sales and Use Tax Collections: Increased by 4.2% ($43.8 million) over last year’s roughly $1.05 billion in collections.

- Net Sales and Use Tax: Decreased by -37.3% (-$189.6 million) totaling to $319.2 million for the month

- Adjusted Sales Tax Distribution to Local Governments: Increased 45.4% (+$240 million) totaling to $768.3 million for the month. This is due to a one-time adjustment resulting from a series of audits undertaken by the Georgia DoR to assist taxpayers in taking corrective action to re-state their previously incorrect Sales Tax allocations for the period of time under review.

- Sales Tax Refunds: Decreased by -39.3% (-$6.6 million) compared to September 2019

The table below shows how the 5 largest sales tax-generating counties, which contributed 35.93% of all sales distribution tax in September, performed.

| County | 2020 | 2019 | % Change |

| Fulton | $24,857,312.46 | $24,186,802.35 | 2.77% |

| Gwinnett | $21,598,650.37 | $14,337,896.43 | 50.64% |

| Cobb | $17,921,475.50 | $13,245,094.24 | 35.31% |

| Dekalb | $13,997,516.29 | $10,671,181.97 | 31.17% |

| Chatham | $ 9,375,186.50 | $ 6,799,556.63 | 37.88% |

The next table shows Georgia’s top 5 and bottom 5 counties in terms of sales distribution tax growth (loss). The 10 counties account for 1.53% of Georgia’s total sales tax revenue generation in September 2020.

| County | 2020 | 2019 | % Change |

| Bleckley | $ 343,529.85 | $ 98,923.15 | 247.27% |

| Wayne | $ 869,319.38 | $ 301,994.05 | 187.86% |

| Jeff Davis | $ 475,090.30 | $ 176,186.10 | 169.65% |

| Lee | $ 690,824.90 | $ 256,559.67 | 169.26% |

| Ben Hill | $ 491,106.60 | $ 182,741.42 | 168.74% |

| Talbot | $ 67,638.01 | $ 79,360.19 | -14.77% |

| Heard | $ 301,339.23 | $ 350,995.15 | -14.15% |

| Lincoln | $ 54,075.01 | $ 58,106.61 | -6.94% |

| Greene | $ 441,129.00 | $ 473,674.65 | -6.87% |

| Taliaferro | $ 13,956.73 | $ 14,886.98 | -6.25% |

Source: Georgia Department of Revenue Sales Tax Commodity Report

Sales Tax: Winners & Losers

During September, 8 industries posted positive growth and 4 industries posted negative growth in Georgia. The higher volume of positive industry growth this month was contributed to higher levels of spending by consumers as well as audits done by the Georgia Department of Revenue that gave back many companies withholdings.

Georgia Industry Winners (Growth compared to September 2019):

- General Merchandise: Increased 360.65%

- Other Retail: Increased 28.93%

- Construction: Increased 26.97%

- Other Services: Increased 15.67%

Georgia Industry Losers (Decline compared to September 2019):

- Accommodation: Decreased -34.87%

- Wholesale: Decreased -16.3%

- Home Furnishings: Decreased -9.48%

- Utility: Decreased -4.26%

Other Tax Collection Revenue

Individual Income Tax: September collections increased by 11.2% (+$126.4 million) with a total sum of $1.26 billion.

- Individual Income Tax refunds issued (net of voided checks) were down -9.4% (-$9.2 million)

- Individual Income Tax Withholding payments increased by 11.2% (+$103.4 million)

- Individual Income Tax Estimated payments decreased by -9.5% (-$20 million)

- All other Individual Tax categories, including Non-Resident Return payments, were up a combined $33.8 million

Corporate Income Tax: September collections increased by 4% (+$10.1 million) from $254.8 million in 2019 to $264.9 million in 2020. The large jump is due to:

- Corporate refunds issued down by -48.4% (-$12 million)

- Corporate income estimated tax payments up by 120.1% (+$12.9 million)

- All other corporate tax categories were down a combined $14.8 million

Motor Fuel Taxes: September collections decreased by -0.7% (-$1.1 million) totaling to $160.9 million.

Motor Vehicle – Tag & Title Fees: September collections increased by 3.6% (+$1 million). Title ad Valorem Tax (TAVT) declined by -3.3% (-$2 million).

Source: Georgia Department of Revenue Press Releases

Georgia Select Policy Changes

This month, Georgia had a variety of policy changes enacted that affect sales tax rates on commodities and specific counties:

- Georgia issues ruling on sales tax application relating to solar power manufacturing equipment

- Georgia issues ruling on sales tax application relating to technology company

- Georgia DoR issues Q&A on alcohol licensees

- Georgia DoR announces various county tax rate changes

- Georgia DoR issues sales tax ruling

- Georgia DoR updates its guidance on Georgia’s conformity to the CARES Act

- Georgia DoR publishes local sales and use tax rates for manufacturing energy

- Georgia DoR issues ruling on sales tax application of taxpayer’s car wash business

- The rule on remote administrative hearings has been made permanent

- Georgia DoR rules on sales tax applicability on resale of hotel room accommodations

September Sales Tax Report Graphs

From the week ending 3/21/2020 through 10/10/2020, the sectors with the most regular UI initial claims processed included Accommodation and Food Services (929,912), Health Care and Social Assistance (447,748), Retail Trade (411,217), Administrative and Support Services (332,963), and Manufacturing (301,771). This month, general merchandise companies in Georgia saw large gains in sales tax distributions (+360.65% compared to last September) due to audits by Georgia’s Department of Revenue adjusting previous incorrect sales tax allocations.

For the month of September, Georgia’s unemployment rate rose 0.7% over August to 6.4 percent, while the national unemployment rate stands at 7.9 percent. Georgia has had a 6.2 percentage drop in unemployment since the beginning of the pandemic in April when the state reported a 12.6 percent unemployment rate, Georgia’s all-time high. In September, the number of employed was down 15,555 to reach a total of 4,628,421, but the number of employed was up by 348,497 since April. Georgia’s labor force in September saw an increase of 19,047, totaling 4,945,161. That number is also up 50,765 since the start of the pandemic in April. Initial unemployment claims were down by 19% (45,833) since August to reach 201,790. This has helped the economy rebound in terms of sales tax generation as more income is available to Georgia residents.

September Georgia Sales Tax Report: Good And Bad News

Good News

Jay Powell says US small businesses may need ‘direct fiscal support’

Atlanta’s Jobs Increase in September

Gov. Kemp Announces $1.5 Billion in CARES Act Funding to Unemployment Insurance Trust Fund

GDOL Issues Over $1 Billion in LWA Benefits

Georgia’s Unemployment Rate Ranks 7th Lowest in the Nation

Bad News

$62 million in alleged PPP fraud was the easy part

Businesses report revenue declines, diminishing cash reserves

Georgia slips even lower among states on new health scorecard

This year state agencies cut: next year they say they need $700 million more

Appendix: GA September Financial Summary

Source: Georgia Department of Revenue September Summary

Follow Us!