May Sales Tax Overview

Georgia’s May gross sales tax and use collections declined by 13.3% compared to 2019. The hardest-hit industries are accommodation (-76.62%), auto (-22.02%), and miscellaneous services (-18.92%). The only industries to post positive growth this month were other retail (+10.86%) and construction (+5.08%). The table below shows how the 5 largest sales tax-generating counties, which contributed 38.58% of all sales tax in May, performed.

| County | 2020 Sales Tax | 2019 Sales Tax | % Change |

| Fulton | $ 17,117,501.03 | $23,738,445.64 | -27.89% |

| Gwinnett | $ 12,468,032.49 | $14,136,715.57 | -11.80% |

| Cobb | $ 11,306,035.54 | $13,293,155.03 | -14.95% |

| DeKalb | $ 8,832,513.93 | $10,364,363.81 | -14.78% |

| Chatham | $ 5,193,183.46 | $ 6,922,951.84 | -24.99% |

The next table shows Georgia’s top 5 and bottom 5 counties in terms of sales tax growth (19.96% total sales tax contribution in May 2020).

| County | 2020 Sales Tax | 2019 Sales Tax | % Change |

| Baker | $ 24,987.36 | $ 15,129.65 | 65.15% |

| Echols | $ 15,797.37 | $ 11,245.16 | 40.48% |

| Glascock | $ 18,034.28 | $ 12,909.55 | 39.70% |

| Lee | $ 332,837.03 | $ 247,496.84 | 34.48% |

| Jones | $ 212,910.16 | $ 158,616.80 | 34.23% |

| Richmond | $ 2,813,224.76 | $ 4,369,031.48 | -35.61% |

| Fulton | $17,117,501.03 | $23,738,445.64 | -27.89% |

| Chatham | $ 5,193,183.46 | $ 6,922,951.84 | -24.99% |

| Dougherty | $ 1,102,337.20 | $ 1,461,908.68 | -24.60% |

| Glynn | $ 1,578,868.46 | $ 2,085,685.86 | -24.30% |

Source: Georgia Department of Revenue Sales Tax Commodity Report

Georgia Other Tax Sources Changes

May net tax collections totaled $1.58 billion for a decrease of $178 million (-10.1%) compared to May 2019 when net tax collections totaled nearly $1.76 billion. YTD net tax collections totaled $20.81 billion for a decrease of roughly $857.9 million (-4%) compared to the previous fiscal year when net tax revenues totaled nearly $21.67 billion.

Individual Taxes

- Net Individual Income Tax collections for May declined by nearly $30 million (-3.4%) compared to May 2019 where net individual tax revenues in aggregate equaled ~$887 million.

- Individual Income Tax refunds issued, net of voided checks, decreased by $0.9 million (-0.6%). Individual Income Tax Return payments decreased by roughly $25 million (-38%) compared to 2019.

- Individual Withholding payments for the month were up $13.1 million (1.4%) versus 2019. All other categories, including Non-Resident Income Tax payments, were down a combined $19 million.

Motor Taxes

- Motor Fuel Tax collections decreased by $39.2 million (-25.7%).

- Motor Vehicle Tag & Title Fees increased by $3.8 million (15.7%) while Title Ad Valorem Tax (TAVT) collections declined by $44.3 million (-57.5%).

Corporate Income Tax

- Net Corporate Income Tax collections decreased by nearly $16.9 million (-40.8%), compared to 2019 where net corporate tax revenues totaled $41.3 million.

- Corporate Income Tax refunds, net of voids, decreased by $6.8 million (-71%).

- Corporate Income Tax Estimated payments received were up $4.6 million (26.5%).

- Corporate Income Tax Return payments decreased by nearly $22.7 million (-90.4 percent)

- All other Corporate Tax types, including S-Corp tax payments, were down a combined $5.6 million.

Source: Georgia Department of Revenue May 2020 Report

Georgia Sales Tax Changes

With overall tax revenue falling, here are the proposed options that could immediately lift state tax collections by nearly $1.3 billion and avert steep cuts that would harm Georgians in every corner of the state:

- Increasing Georgia’s tobacco tax, which currently ranks No. 48 out of 50 states, to the national average to generate roughly $600 million per year.

- Trimming back the $9.8 billion in annual tax expenditures, credits, and loopholes offered in Georgia.

- Eliminating Georgia’s itemized tax break for state taxes paid, also known as the “double deduction,” which could generate $175 million per year

Source: Georgia Governor’s Budget Report Amended Fiscal Year 2020 & Fiscal Year 2021

Georgia Budget Changes

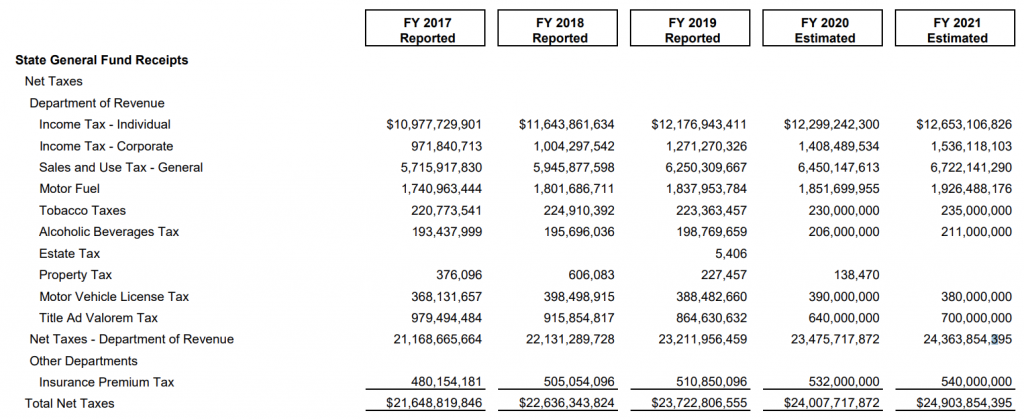

In 2019, total net tax collection were $23,722,806,555. Georgia’s estimates for net tax collection for 2020 and 2021 are $24,007,717,872 and $24,903,854,395 respectively (1.63% 3Y CAGR). Historically between 2017-2019, sales tax had a 3Y CAGR of 3.10%. Due to a lack of growth in anticipated tax collection, Georgia legislatures finalized a 10% cut of the state budget for FY 2021, lower from the initial 14% cut proposed, which will reduce spending by ~$2.2 billion.

Highlights of budget changes

- $250 million cut to the University System of Georgia and $40 million cut to the Technical College System of Georgia; budget cuts will result in furlough days, layoffs, downsizing and elimination of programs, instructional site closures, elimination of student success initiatives and more

- $1.05 billion cut from the Quality Basic Education program, the formula that dictates the bulk of state spending for public education

- $122 million cut in total funding to the Department of Behavioral Health and Developmental Disabilities

- A $205 million reduction in state funds was offset by an increase in federal Medicaid and PeachCare funds, which helped prevent cuts being made to Medicaid eligibility, benefits or provider payments

- $27.4 million cut in total funding for the Department of Public Health

- A $100 million cut to the Department of Human Services budget, representing a 12 percent cut from FY 2020

- $133 million cut in total funding for the Department of Corrections

Source: Georgia Governor’s Budget Report Amended Fiscal Year 2020 & Fiscal Year 2021

May Sales Tax Report Graphs

According to the Georgia Department of Labor, the May preliminary unemployment rate was 9.7%, a decrease of 2.9% from April’s 12.6%. The number of employed was up 144,877 over April, but down 480,592 compared to this time last year totaling 4,424,801.

For the select industries in the graph above, jobs were up 79,600 over the month of April showing gains in Accommodation and Food Services (45,800), Health Care and Social Assistance (10,700), Non-Durable Goods Manufacturing (7,000), Administrative and Support Services (6,300), Professional, Scientific, and Technical Services (4,600), and Wholesale Trade (4,500).

Amidst rising Georgia COVID-19 cases, Georgia sales tax continues to decline. Despite reopening most of the economy, many businesses are faced with less consumer spending.

Chart Source: Georgia Department of Revenue Sales Tax Commodity Report

May Georgia Sales Tax Report: Good And Bad News

Good News

Georgia budget gap passes $850 million as revenues again lag

Raised sales taxes on sin goods anticipated to raise more state funds

Bad News

FY 2021 Georgia budget cut by 10%

Sales tax collections continues to decline

Appendix Pictures

Follow Us!